When Will 2019 Medicare Plans Be Available to Review

Each year, people with Medicare can review their coverage options and modify plans during the open up enrollment menstruation (Oct 15 to December 7). Medicare beneficiaries with traditional Medicare can compare and switch Medicare Role D stand-alone drug plans or join a Medicare Advantage plan, while enrollees in Medicare Advantage can compare and switch Medicare Reward plans or elect coverage nether traditional Medicare with or without a stand-solitary drug program. Beneficiaries have no shortage of plans to choose from: in 2021, the average Medicare beneficiaries tin cull among 33 Medicare Advantage plans and 30 Role D stand up-alone prescription drug plans (PDPs).

Coverage and costs vary widely amidst both Medicare Advantage plans and Office D prescription drug plans. Plans can change from one year to the adjacent, which could lead to unexpected and avoidable costs, and disruptions in intendance for beneficiaries who do not review their options annually. For example, provider network changes could hateful beneficiaries lose admission to their preferred doctors, while changes in the list of covered drugs and cost-sharing requirements could result in college out-of-pocket drug costs. Farther, beneficiaries' health care needs can change from one yr to the side by side, making it even more of import to compare coverage options annually. Even without a change fabricated by their programme or a change in health status, beneficiaries may be able to find a plan that better meets their individual needs. The Centers for Medicare & Medicaid Services (CMS) recommends that beneficiaries review and compare Medicare plans each year.

This analysis builds on our prior KFF piece of work to examine the share of Medicare beneficiaries who compared plans during the 2018 open enrollment period for coverage in 2019, the share who compared drug coverage in Medicare Advantage and stand-alone drug plans, and variation by demographic characteristics, based on an assay of the 2019 Medicare Electric current Beneficiary Survey (the most recent twelvemonth available). All reported results are statistically significant.

Findings

7 in 10 (71%) Medicare Beneficiaries Did Not Compare Medicare Plans During the 2018 Open up Enrollment Menses

With the large number of Medicare private plans – Medicare Reward and stand up-alone Medicare prescription drug plans – offered each year in addition to traditional Medicare, beneficiaries have the opportunity to reassess their coverage each year during the Medicare open enrollment catamenia. Traditional Medicare beneficiaries can compare and switch Medicare Part D stand-alone drug plans or decide to enroll in a Medicare Reward plan, and can also evaluate Medigap supplemental insurance plans, known as Medigap. Enrollees in Medicare Advantage can similarly compare and switch Medicare Advantage plans or decide to receive coverage under traditional Medicare with or without a stand-alone drug program and with or without Medigap.

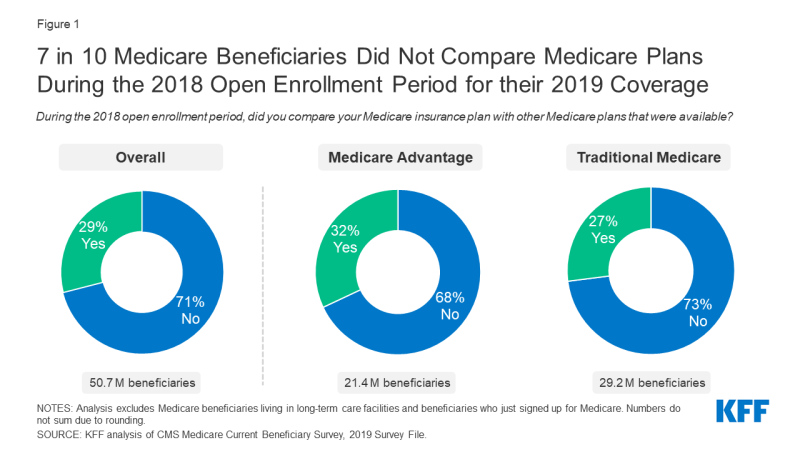

In 2019, 71% of all Medicare beneficiaries reported that they did not compare their plan to other Medicare plans that were available during the 2018 open enrollment period, while 29% of all Medicare beneficiaries reported that they compared Medicare plans (Effigy 1; Tabular array 1). Amongst beneficiaries in Medicare Reward plans, 68% reported that they did non compare Medicare plans during the 2018 open up enrollment period, compared to 73% of those in traditional Medicare (Table ane).

Effigy 1: 7 in ten Medicare Beneficiaries Did Not Compare Medicare Plans During the 2018 Open Enrollment Catamenia for their 2019 Coverage

The share of all Medicare beneficiaries who said they did not compare Medicare plans during the 2018 open enrollment catamenia was higher among Black (74%) and Hispanic (79%) beneficiaries, beneficiaries ages 85 and older (84%) and under age 65 with disabilities (77%), and beneficiaries with lower incomes (85%), fewer years of education (due east.g., 82% for those with less than a high schoolhouse education), living in rural areas (73%), those in relatively poor health (74%), and those enrolled in both Medicaid and Medicare (e.grand., 87% for full-dual eligibles) (Figure two).

Nigh Beneficiaries in Medicare Advantage Drug Plans and Stand-alone Drug Plans Did Not Compare Drug Coverage in 2019

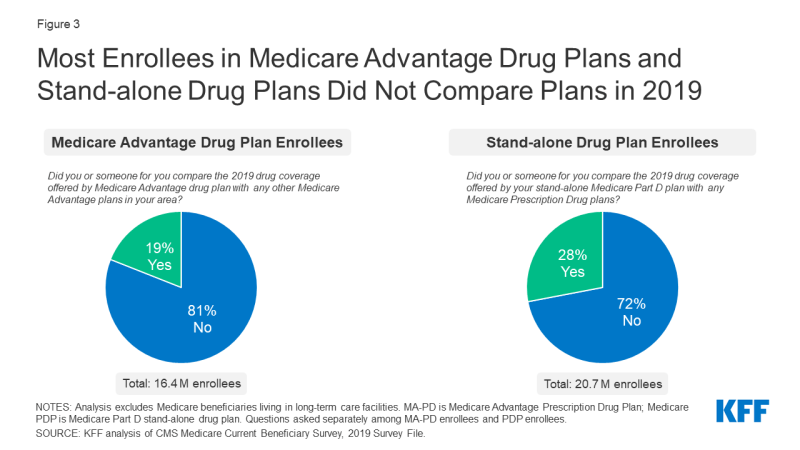

In 2019, eight in 10 (81%) beneficiaries in Medicare Advantage drug plans (MA-PDs) said they did not compare the drug coverage offered by their current MA-PD plan to whatsoever other MA-PD in their area (Effigy 3; Table 2). Among stand-lonely drug plan (PDP) enrollees, more than than 7 in x (72%) said they did non compare drug coverage offered by their current PDP to other PDPs.

Figure 3: Most Enrollees in Medicare Advantage Drug Plans and Stand-solitary Drug Plans Did Not Compare Plans in 2019

The share of beneficiaries in both types of drug plans who did not compare drug coverage in 2019 was higher among those who are Hispanic (88% of MA-PD and 85% of PDP enrollees), ages 85 and older (xc% of MA-PD and 80% of PDP enrollees), with incomes under $10,000 (87% of MA-PD and 81% of PDP enrollees), and those enrolled in both Medicaid and Medicare (e.grand., 91% of MA-PD and 87% of PDP full-dual eligibles) (Tabular array 2).

Medicare's Website, Toll-Costless Number, and Handbook Are Not Widely Used past Beneficiaries

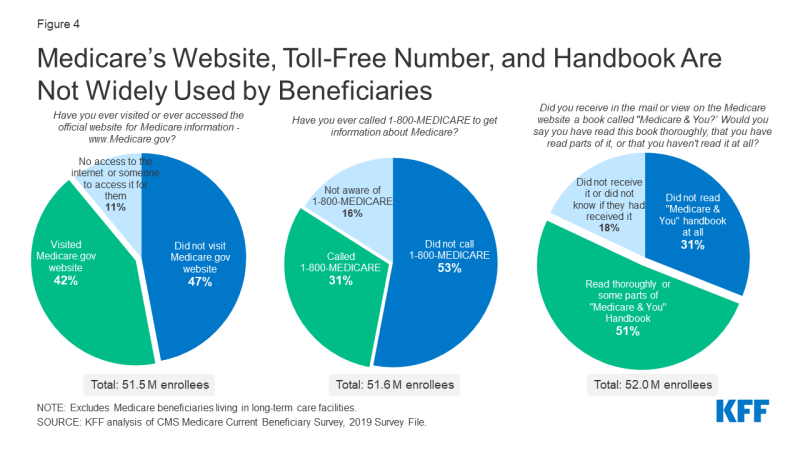

- Almost half (47%) of all beneficiaries with Medicare said they had never visited the official Medicare website for information, while 42% said they said they (or someone for them) had ever visited the website, and the remainder (11%) reported they did not accept access to the internet or had no i to access it for them (Effigy 4).

- 53% of all Medicare beneficiaries reported they had never called the 1-800-MEDICARE helpline for data, while 31% reported they had always called the helpline, and another xvi% said they were not aware this helpline existed.

- Half (51%) of Medicare beneficiaries reported they had read thoroughly or some parts of the Medicare & Y'all handbook, while almost one-tertiary (31%) reported they had not read it at all. Well-nigh ane in 5 (18%) Medicare beneficiaries reported they did not receive information technology or did not know if they had received information technology.

Figure 4: Medicare'due south Website, Toll-Gratis Number, and Handbook Are Not Widely Used by Beneficiaries

The share of Medicare beneficiaries who did non use Medicare data sources varied among subgroups of beneficiaries (Tabular array 3). For instance, a larger share of Black (52%) beneficiaries than White (46%) never visited the Medicare.gov website. Additionally, 52% of beneficiaries with incomes under $10,000 did non visit the Medicare.gov website, compared to 41% among those with incomes greater than $40,000. Over ane in 3 (39%) beneficiaries enrolled in Medicaid and Medicare read the Medicare & Yous handbook compared to 53% of those non enrolled in Medicaid and Medicare.

Discussion

The marketplace of Medicare individual plans operates on the premise that people with Medicare will generally compare plans to select the best source of coverage, given their private needs and circumstances. This analysis finds that virtually Medicare beneficiaries did not compare plans during the 2018 open enrollment catamenia for coverage in 2019, and most people in stand-alone drug plans and Medicare Advantage drug plans did not compare the drug coverage offered past their PDP or MA-PD to other drug plans in 2019.

We as well find that beneficiaries who may be more likely to be afflicted past plan changes from one year to the side by side, such as older beneficiaries, beneficiaries who are under historic period 65 with disabilities, and those in worse wellness, were the least likely to written report comparing plans during the 2018 open up enrollment period for their 2019 coverage, which tin lead to higher out-of-pocket costs and disruptions in intendance. Additionally, our assay finds that beneficiaries who are Black and Hispanic, with low incomes, and fewer years of educational activity were less likely to compare plans during the 2018 open enrollment period.

This assay builds on previous KFF analyses which suggest that the market of Medicare plans may not be working equally intended. Previous KFF analyses accept shown that more than than half of Medicare beneficiaries do not compare or review their Medicare wellness coverage options annually and that a small share of Medicare beneficiaries voluntarily switch plans. This "stickiness" could suggest beneficiaries are satisfied with their current coverage. Even so, by KFF analysis, based on focus groups, has revealed that while many Medicare beneficiaries know nigh the open enrollment menses and are generally enlightened that they should compare plans, many likewise discover the process of comparing plans challenging.

With a growing number of Medicare private plan choices available each twelvemonth, the fact that such a large share of seniors and people with disabilities report not comparing plans during the open enrollment period warrants attention, given the potential consequences of year-to-year programme changes for their coverage, access to intendance, and out-of-pocket costs.

| Methods |

| This analysis uses survey data for customs-habitation Medicare beneficiaries from the Centers for Medicare & Medicaid Services (CMS) Medicare Current Beneficiary Survey (MCBS) 2019 Survey File. The analysis of plan comparison during open enrollment and utilise of Medicare information sources used questions from the Medicare Plan Beneficiary Knowledge topical segment, and the analysis was weighted to correspond the ever-enrolled Medicare population in 2019 using the topical survey weight KNSEWT and relevant replicate weights. This assay excludes beneficiaries who reported but enrolling in Medicare. The analysis of MA-PD/PDP drug plan comparison used questions from the RX Medication topical segment; like as above, the analysis was weighted to represent the ever-enrolled Medicare population in 2019 using the topical survey weight RXSEWT and relevant replicate weights. Both analyses exclude beneficiaries with Office A or Part B just and those with Medicare as secondary payer. Results from all statistical tests were reported with p<0.05 are considered statistically significant. |

Source: https://www.kff.org/medicare/issue-brief/seven-in-ten-medicare-beneficiaries-did-not-compare-plans-during-past-open-enrollment-period/

0 Response to "When Will 2019 Medicare Plans Be Available to Review"

Post a Comment